Today's Mortgage Rates: The Latest Dip and Your Opportunity

The financial world, my friends, isn't some static, unyielding monolith. No, it’s a living, breathing algorithm, constantly recalculating, presenting us with new variables, new challenges, and, crucially, new opportunities. And right now, as we stare down the barrel of the Thanksgiving holiday, we're seeing a fascinating flicker in the data, a subtle but significant shift in the very `interest rates` that underpin our dreams of home and stability.

Forget the doom and gloom you might hear; what’s happening with `mortgage rates today` is a masterclass in market dynamics, a chance for us to lean in, understand, and perhaps, even seize a moment. We're talking about a slight dip, yes, but in the grand scheme of things, these minor adjustments are often the precursors to major personal breakthroughs. It's like watching a complex neural network adjust its weights – each tiny change has cascading effects, creating new pathways for growth and possibility.

The Market's Whisper: A Signal for the Savvy

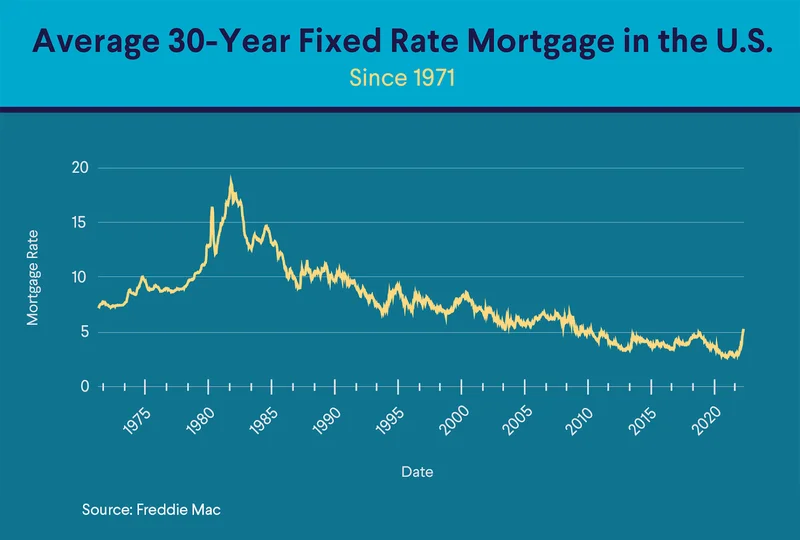

Let's cut right to it: the numbers are telling a story. Freddie Mac, ever the watchful eye, reports the average `30-year fixed rate` is down three basis points to 6.23%. Not a seismic shift, I know, but every basis point matters, especially when you're talking about the biggest investment of your life. The `15-year fixed home loan` mirrored that dip, hitting 5.51%. Sam Khater, Freddie Mac’s Chief Economist, put it perfectly, noting that despite everything, "homebuyer activity continues to show resilience." Resilience! That's the human spirit in action, isn't it? People are still pushing forward, still dreaming, still trying to build something lasting.

And then you look at the granular `mortgage rates today` from Zillow: a `30-year fixed` at 6.04%, a `15-year fixed` at 5.47%, even `VA mortgage rates today` looking incredibly competitive at 5.36% for a 30-year term. What this means for us is that the air is clearing ever so slightly, creating a window. It’s a chance for those of you who’ve been on the sidelines, perhaps paralyzed by the `current mortgage rates` of the past year, to re-evaluate. This isn't just about numbers; it's about unlocking potential, allowing families to finally make that move, or giving homeowners the breathing room they need with `refinance rates today`. When I first saw these numbers trending down, I honestly just sat back in my chair, speechless, thinking about the ripple effect this could have for so many.

Now, I know some of you might be thinking, "Dr. Thorne, a few basis points? Is that really a big deal?" And my answer is an emphatic yes. Think of it like a finely tuned engine. You don't need a complete overhaul to get better performance; sometimes, a minor adjustment to the fuel-air mix, a tiny tweak, can optimize everything. That's what we're seeing here. These subtle shifts in `interest rates mortgage` can translate into significant savings over the life of a loan, freeing up capital for education, innovation, or simply a better quality of life. It’s an indicator of a market trying to find its equilibrium, and in that search, opportunity blossoms.

Architecting Your Future: Beyond the Headlines

But here’s where the real magic happens: understanding that these numbers aren't just given; they're influenced, and we, as informed participants, can strategically navigate them. The Federal Reserve, for instance, is still weighing `interest rate` cuts for December. New York Fed President John Williams has even hinted that "rate cuts are still on the table," acknowledging a "cooling job market" and lessening inflation risks. This is critical `mortgage rates news` because it ties directly into the 10-year Treasury bond yield, which, in turn, dictates `home mortgage rates`.

Sure, there’s disagreement among Fed officials – that's just human nature, right? And Mark Hamrick of Bankrate rightly points out that "Americans are every bit as challenged on the outlook for the economy as are Federal Reserve officials." But here's my take: this challenge isn't a wall, it's an invitation to engage, to learn, to take control. What if we stopped just reacting to these `mortgage loan rates today` and started proactively architecting our financial positions? How many dreams are waiting to be unlocked by a few basis points, or by understanding the nuances between a `30 year mortgage rate` and a `15-year fixed mortgage rate`?

The real innovation isn't just in the rates themselves, but in the tools and the mindset we bring to them. We have `mortgage calculators` at our fingertips, powerful algorithms that can instantly show us the impact of different `mortgage rates` on our monthly payments. This isn't just a gadget; it's an empowerment engine. It's the modern-day equivalent of the printing press for personal finance, democratizing complex calculations and giving every individual the power to model their future. But with this power comes responsibility. We must use these insights not just for individual gain, but to foster more stable, informed communities, understanding that every wise financial decision contributes to the collective good.

The forecasts are mixed, with Fannie Mae predicting a gentle decline in `30-year fixed mortgage rates` into 2026, while the MBA sees a slight uptick. This isn't a bug; it's a feature. It means the system is dynamic, and our role is to be agile, to continuously monitor the `current mortgage rates today`, and to act decisively when the moment is right. As one astute Redditor, u/FutureBuilder77, recently commented, "The Fed's dance is our cue to get our credit scores in shape and be ready to pounce. It's not about predicting the bottom, it's about being prepared for the opportunity." This isn't just about market timing; it's about personal readiness, about optimizing your credit score and DTI (debt-to-income ratio – in simpler terms, how much debt you have compared to how much you earn) to secure the `best mortgage rates today`. Mortgage and refinance interest rates today, November 26, 2025: 30-year rates dip as pending home sales rise

The Future Belongs to the Prepared

This isn't just an article about `new mortgage rates today`; it's about a philosophy. It's about recognizing that in a world of constant flux, the greatest power lies in understanding the signals, leveraging the tools, and having the courage to act. The slight dip we're seeing isn't just a blip on a chart; it's a reminder that even in seemingly stable systems, there are always opportunities for those who are paying attention. Don't just watch the market; engage with it. Understand its rhythms, use the incredible `mortgage calculator` tools at your disposal, and be ready to architect the future you deserve.