Mortgage Rates Today: The 'Dip' and Your Real 30-Year Refi Chances

The Fed's Little Game: A Quarter Point Here, A Quarter Point There… Who's Really Winning?

Alright, let's talk about these "falling" mortgage rates, shall we? Because every time some financial pundit starts cheering about a few basis points, I gotta wonder who they’re really trying to convince. We're in late November 2025, Thanksgiving leftovers are probably still haunting your fridge, and the big news is that your 30-year fixed just slipped to a whopping 6.03% APR. Oh, joy. A whole two basis points down. Excuse me if I ain't popping champagne.

The cheerleaders at NerdWallet and the other corporate mouthpieces are practically doing cartwheels because the average 30-year fixed-rate mortgage fell two basis points. Two. That's 0.02% for those of us who skipped the advanced finance class. And a 15-year? Three basis points. A 5-year ARM managed a whopping six. They want us to believe this is some kind of major victory, a sign of good things to come. But I'm looking at these numbers, and honestly, it feels like we're being offered crumbs from a banquet we were never invited to. They're telling us this is a "refinance opportunity" for hundreds of thousands of homeowners still stuck above 7%. My question is, why were so many folks ever stuck at 7% in the first place? And why is 6% still considered a "deal"? Give me a break.

The Puppet Masters and Their Strings

So, what's behind this monumental shift? The "experts" are pointing fingers at a weakening labor market and the Federal Reserve, of course. Apparently, the market is "convinced" the Fed will cut short-term rates in December. New York Fed president John Williams, San Francisco Fed president Mary Daly, and Federal Reserve Governor Christopher Waller have all signaled their support for cuts. Signaled. Like they're sending smoke signals from a mountain top, rather than just, you know, doing something. It’s always a dance, isn't it? A little peek behind the curtain, a whisper here, a nod there, and suddenly the entire market starts to move like a school of fish.

They say these decisions by the nation's central bank "ripple out" to longer-term loans like mortgages. It's like watching a magician pull a rabbit out of a hat, only the rabbit is your monthly payment, and the hat is a labyrinth of economic jargon. We're told that factors we can change—credit score, down payment, loan type—matter. Sure, they do. But then they drop the real bombs: forces you can't control. The U.S. economy, the global economy, the mythical Federal Reserve, the housing market. These are the leviathans in the ocean, and we're just tiny rowboats hoping not to get swamped. They tell us a hot housing market means less incentive for lenders to compete. Translation: when they're making bank, they don't care about you. It's a system designed to look complex, but the bottom line is always the same: someone else is pulling the levers, and you're just along for the ride.

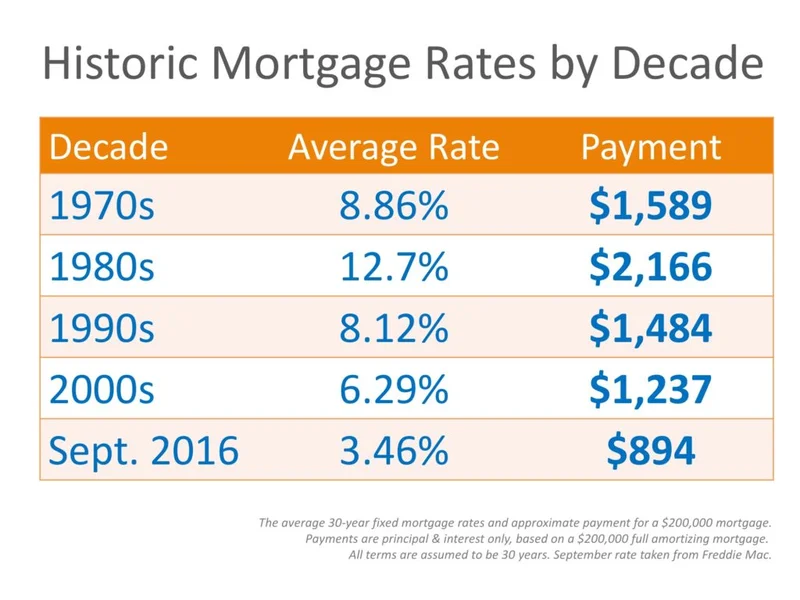

And this talk about "2025-lows" as the year closes? Jake Krimmel, some Realtor.com economist, thinks this will "give homebuyers something to be thankful for heading into 2026." Thankful? For rates that are still historically high for anyone who remembers a decade ago? It's like being grateful for a slightly less painful toothache. This ain't a gift, it's a recalibration, a slight easing of the chokehold after years of squeezing. They're dangling a carrot, hoping we'll forget the stick they've been beating us with.

It's Always a Catch-22

The advice is always the same, too: "shop around." Freddie Mac says comparing four lenders could save you $1,200 annually. Over the life of a loan, that's $22,000 on a $360,000 mortgage. Sounds like a lot, right? But think about the stress, the paperwork, the credit score hits from multiple inquiries, all for a savings that, while not insignificant, feels like pocket change compared to the overall cost of homeownership in this economy. We're supposed to jump through hoops, provide all our personal data, just to shave off a fraction of a percentage point. It's exhausting. And let's be real, many lenders' "personalized rates" are still just samples until you're deep into the process. They bait you with a low number, then hit you with fees and points that make the APR look a lot less attractive. It's a classic move.

This whole thing feels like a rigged game where the house always wins. They bump the rates up, then slowly, agonizingly, trickle them back down a bit, and expect us to applaud. We're told to be thankful for 6% when our parents bought homes at half that. I mean, are we really supposed to believe this is progress? Or is it just the financial elite playing their little shell game with our biggest investments? Sometimes I wonder if they just throw darts at a board to decide where these interest rates should land. Then again, maybe I'm just too cynical for my own good.