TMC Stock: Price & News Updates

TMC's High-Stakes Bet: Decoding the CFO's Short Squeeze Play

The Metals Company (TMC) just delivered another spike, with its stock price jumping nearly 24% after-hours on Wednesday. The catalyst? Direct, pointed remarks from CFO Craig Shesky, who didn’t mince words on the Rock Stock Channel podcast, essentially telling short sellers to start sweating. "If I were short the stock right now, I would be quite nervous," Shesky stated, adding that a "very bad day" could be on the horizon for those betting against the deep-sea miner. The Metals Company (TMC) Stock Surges 24% After-Hours on CFO Comments

This isn't just bravado; it’s a calculated narrative play, a direct challenge to the 13.7% of TMC’s float held short. My analysis, however, suggests that while the setup for a squeeze is certainly present, the underlying fundamentals of TMC remain a complex, high-risk proposition, dependent on variables far beyond the company’s direct control. The market’s reaction, specifically the surge in `tmc stock price`, reflects more anticipation than concrete certainty.

The CFO's Gauntlet: A Deep Dive into the Short Thesis

Let’s be precise about what Shesky is articulating. He's not just talking up the stock; he's drawing a line in the sand. With roughly 25 million shares currently held short, any significant positive news could trigger a rapid unwinding of those positions, forcing shorts to buy back shares and propelling the price higher. This is the classic short squeeze playbook, and Shesky is openly calling it out.

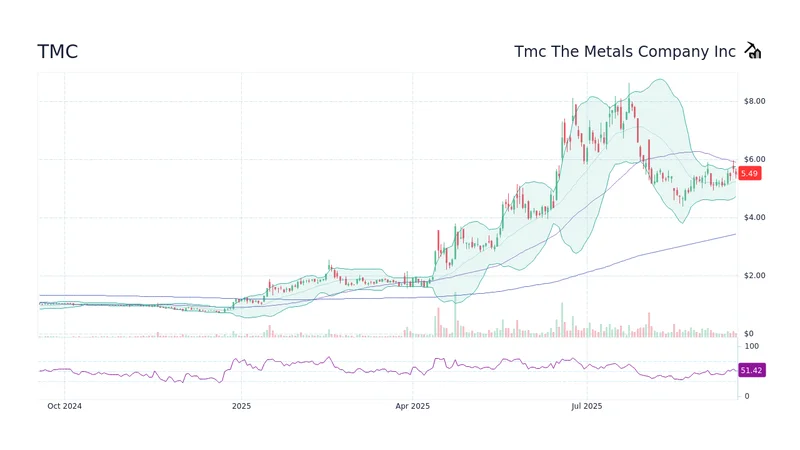

The `tmc stock news` has been a rollercoaster this year. Shares surged an incredible 854% at one point in 2025, only to pull back sharply, sitting at a still impressive 385% year-to-date gain, but down 49% from their October highs. November alone saw a 17% decline. This kind of volatility isn't for the faint of heart, or for investors who rely solely on traditional valuation metrics. It’s the kind of chart that screams "speculative play," where narrative and momentum often trump earnings reports.

Shesky's confidence stems from two primary pillars: a strengthened cash position and ongoing regulatory progress. The company ended its third quarter with $115 million in cash, which, according to Water Tower Research analyst Dmitry Silversteyn, gives TMC a runway of a couple of years at its current burn rate. Furthermore, there's potential to raise an additional $430 million from existing warrants. Financially, on the surface, they're not immediately desperate for capital.

But what exactly is the "thesis" Shesky questions for short sellers? Is it simply a bet against regulatory approval, or is there a deeper skepticism about the commercial viability and environmental hurdles of deep-sea mining? That’s the real analytical question we need to ask. A robust cash position is good, certainly, but it doesn't automatically translate into sustainable profits in an unproven industry.

Beneath the Surface: Unpacking the Fundamentals and Hurdles

TMC’s primary asset is its claim to polymetallic nodules on the Pacific Ocean seafloor, valued at an estimated $23.6 billion. Compared to its current market capitalization of approximately $2 billion (a significant increase from earlier valuations, but still a fraction of the estimated resource value), the perceived upside is enormous. This valuation gap is a core component of the bull case, suggesting the `tmc stock price` is significantly undervalued relative to its potential.

On the regulatory front, there’s genuine movement. President Trump's executive order in April aimed to accelerate deep-sea mining, positioning it as a strategic imperative to counter China’s dominance in critical mineral supply chains. TMC is actively engaged with U.S. government agencies, including the Department of Energy and the Pentagon. Shesky hinted at positive developments, stating that conversations are "moving in the right direction." He even suggested production could begin before the stated Q4 2027 timeline if regulatory roadblocks clear swiftly.

However, this is where the calm, data-driven analysis must introduce a dose of reality. The $23.6 billion valuation, while impressive, relies heavily on future extraction, processing, and market conditions—all contingent on receiving full mining approval, not just exploratory licenses. I've reviewed countless resource valuations, and the discount rates applied to such distant, uncertain cash flows (especially in a nascent, environmentally contentious industry like deep-sea mining) can be incredibly aggressive. How robust is this figure if the regulatory process hits unexpected snags, or if environmental opposition gains more traction globally? This is a crucial methodological critique.

And this is where I find the narrative begins to diverge from the raw financial data. TMC's third-quarter earnings report showed a net loss of $184.5 million, a significant jump from $20.5 million in the same quarter last year. While the cash position provides a buffer, a widening net loss indicates substantial ongoing operational costs before any commercial revenue stream is established. The speculative enthusiasm driving the `tmc stock price` in October was tied to geopolitical tensions around rare earth exports, which eased after a U.S.-China trade truce. This suggests market sentiment is highly sensitive to external, often unpredictable, factors.

Online sentiment, as an anecdotal data set, certainly leans bullish, with Stocktwits users in "extremely bullish" territory. Comments like "Deep sea mining will become a sector of its own and will separate from the mining industry because we do not mine, we harvest. This is much bigger than we can imagine," or the more colorful "it is genuinely safer to let a 5-year-old play with matches than it is to go short on TMC," reflect intense conviction. But conviction, however fervent, does not pay quarterly dividends. It’s a powerful driver in a short squeeze, but not a substitute for sustained profitability.

A Calculated Risk, Not a Certainty

Craig Shesky is playing a high-stakes game. He’s leveraging legitimate progress on the regulatory front and a strong cash position to directly challenge short sellers, aiming to trigger a squeeze that could send the `tmc stock price` soaring. The potential for a "very bad day" for shorts is real, especially if a definitive regulatory green light arrives sooner than expected.

However, investors need to understand that this isn't a fundamental value play in the traditional sense, not yet. It's a calculated gamble on regulatory breakthroughs and market mechanics. The path to commercial deep-sea mining is fraught with significant environmental concerns, technological hurdles, and substantial capital requirements beyond current cash on hand. While the resource valuation is compelling, its realization is years away and highly conditional. The narrative is strong, but the numbers, particularly the escalating net loss, demand a level of analytical skepticism. This isn't a "set it and forget it" investment; it’s a speculative bet on a future that’s still being written, one regulatory approval at a time.